Foreclosure Scam with Declining Housing Prices

States like Michigan have had a 147% increase in foreclosures in the last month alone (InfoTrac, 2020). The unemployment rate is also considered extremely high in the area with 8.2% of the population unemployed. If were to add the people not even registered to work within the Detroit area the numbers might actually be around 15%. To make matters worse, a new 7 year foreclosure scam is actually working its way through local banks.

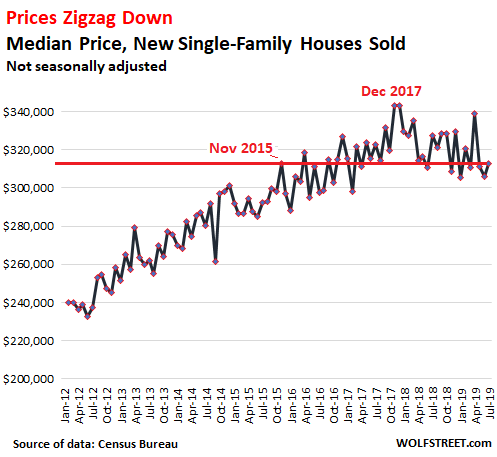

In some areas around the Detroit Michigan area house values have declined as much as 20%. In a few places the price for non-traditional real estate like commercial buildings, condos and vacant land can be found at a 50% discount. This is putting a lot of pressure on people who bought their houses for many tens of thousands of dollars more than what it is currently worth.

Prior to the downswing in the economy and the collapse in the housing market, Michigan touted excellent wages when compared to many other states. The automotive, engineering and skilled labor of the area were being paid a lot of money due to technical ability and union interference. With the abundance in wages the housing prices in upscale neighborhoods continued to rise to unprecedented highs.

As housing prices continued to drop in value every quarter many workers have become frustrated with their loss of value. They are frustrated because they still owe more on their houses then they are actually worth. When they bought the house for $180,000 while still owing $130,000 but the neighbor’s house is now offered on the market for $95,000 it causes a lot of speculation.

Some people are taking out a second mortgage on their home and utilizing that money as a down payment and start-up money for their new home. Once they purchase their new home they allow their old home to go into foreclosure putting additional stress on banks. The old home goes up for foreclosure, the owner walks away with $40,000 or $50,000 in cash and they get a home for under market value.

What are the advantages of the home owner when foreclosing? If the owner can up-grade to a higher quality home for less and put $50,000 into their pocket before doing so, they are placing bets on the economy. It is projected that it will take 5-7 years for the economy to improve and the discounted prices of their new home to return to full value. In addition it will take longer than 7 years to pay down the home loan on their old house to the levels they can purchase a new home.

Owners are advantaged by the foreclosure. Even though their credit is destroyed for 7 years they will not only be able to take with them the $50,000 they pulled out in the foreclosure but will also be able to earn an additional $80,000 in equity when prices rise in 5-7 years. Some of the home owners seek renters to pay the mortgage on their old homes. If they can’t find a renter they simply foreclose.

It should also be noted that since lenders are in dire straits they are willing to extend credit to anyone who can show they have the income to pay for it. Many of these defaulted home owners are able to build their credit back up within a matter of a few years. They obtain prepaid credit cards, take out small loans and pay them back or finance vehicles (the automotive industry is really looking to sell cars). The defaulted home owners have a lot to gain and only a little to lose.