Rent vs. Buy Calculator – Is it Better to Rent or Buy

The rent vs. buy argument seems easy enough argue in the face of historically low interest rates and rising home values around the country. However, according to the Joint Center for Housing Studies at Harvard University, more Americans are renting a home or apartment longer. About 37 percent of American households choose to rent today. This is the highest such level since 1965.

Since the cornerstone of the American dream is homeownership for many, does notbuying a home lead to a protracted financial disadvantage? After all, owning a home allows the owner to build equity. In a rising real estate market, home equity can mean getting on the fast track to wealth creation. In contrast, renting means the tenant is “throwing money away.”

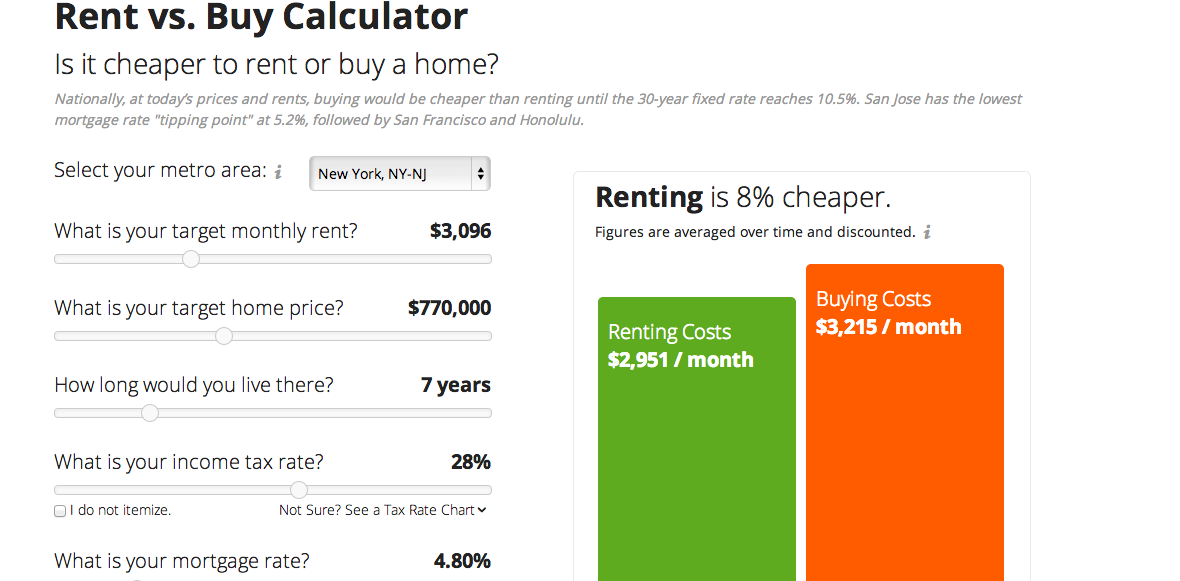

The argument for renting (not buying) a house doesn’t assume the tenant is throwing his or her money away. Instead, it assumes a number of other factors. For instance, the renter invests his or her down-payment funds in a higher return vehicle. Use the New York Times buy-rent calculator https://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html to answer the question “Is it better to rent or buy?”

Rent vs. Buy Argument

Arguing the rent vs. buy question is similar to debating the benefits of an active investment vs. a passive investment strategy. Some financial advisors in today’s world fiercely argue that investors can’t perform any better than the broad market. Successful investors believe there’s benefit in picking stocks for the long-term. Since it’s impossible to know which strategy is “right” over a certain period of time, it’s difficult to discuss how much risk was assumed along the way.

Both financial instruments and real estate have attractive long-term investment potential. The argument for home ownership is persuasive. For instance, if you plan to stay in the home for five to seven years or longer, a home mortgage performs like a forced savings account. On the opposite side of the argument, the homeowner is paying the mortgage lender hundreds of thousands over the life of the loan in interest to build equity. Some financial experts refer to mortgage interest as the “cost” to enforce positive saving behavior.

Protection from Rising Rents

Buying a home tends to protect owners from bearing the cost of rising rents. A traditional fixed rate mortgage remains constant over the life of the loan. Buyers also use borrowed money that’s likely to increase in value over the long-term. However, it’s difficult or impossible to predict how well any homeowner will do by buying a home or renting property. Some research shows that a renter who invests his or her down payment and savings from renting a home often has more money over 10 or 20 years.

Many financial experts agree that it’s a bad idea to view the purchase of a home as an investment. Over the years, the homeowner must maintain the property, pay taxes, buy property & casualty insurance, and absorb real estate commissions.

Considerations of the Rent vs. Buy Argument

Visit Trulia’s rent vs. buy calculator at https://www.trulia.com/rent_vs_buy/ to consider your personal financial situation. Input:

- Your metro area

- Target monthly rent

- Target home price

- Length of time you’ll live in a home

- Tax rate

- Mortgage rate

- Access to special low mortgage rate programs (e.g. FHA or veteran’s loan programs)

- Down payment

- Mortgage term

- Buying, selling, and closing costs

- Long-term capital gains (15 percent)

- Property taxes

- Insurance

- Renovations

- Utilities, etc.

Real Estate Market Timing

In today’s buoyant real estate market, it’s difficult to believe that home prices don’t move up in a straight line. According to the author of “Irrational Exuberance,” (2000) U.S. home prices over the past 100 years have appreciated less than 0.5 percent on an annualized net of inflation basis. Compared to stock market performance over the last century, stocks have widely outperformed the average U.S. home price.

Most homeowners enjoy equity growth over time. Homeownership can become a retirement safety net. Harvard’s Joint Center reports that, even after the Global Recession housing crash, homeowners who purchased real estate after 1999 were significantly ahead by 2013. http://jchs.harvard.edu/research/publications/update-homeownership-wealth-trajectories-through-housing-boom-and-bust

Regardless of the rent vs. buy argument, there are special, personal reasons that most Americans value homeownership. Buying a home is an important rite of passage. A home provides a sense of belonging to a neighborhood or community. It’s worth far more than the homeowner’s equity.